After spending the first half of the year collecting feedback from residents to assess the needs and priorities of the community, Plano City Manager Mark D. Israelson presented the recommended budget for the upcoming fiscal year 2022-23. On August 8, the city council held a public hearing on the operating budget.

The budget includes a combined operating revenue of $738,696,067 and expenditures of $677,024,132.

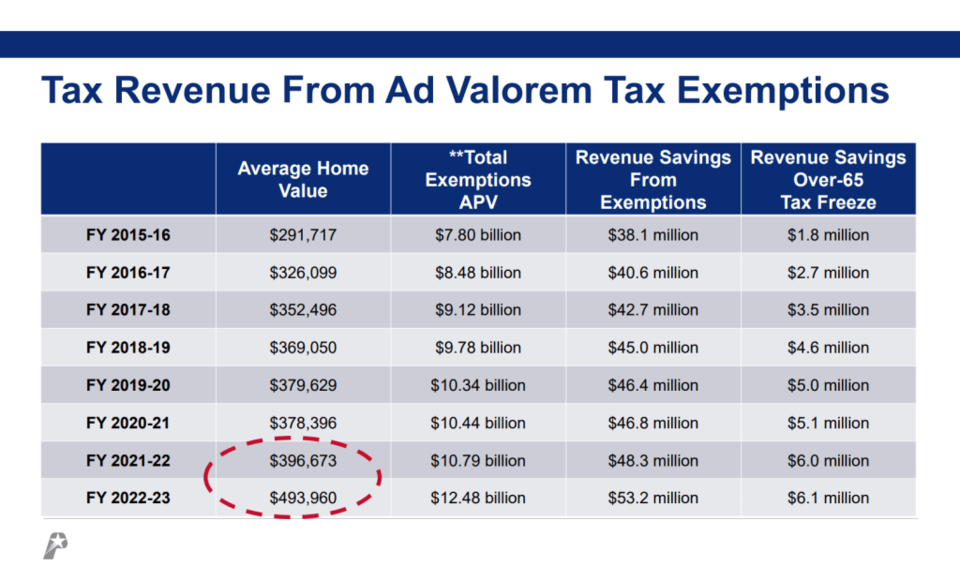

One of the main features of the presentation concerns affordability and property tax. According to city documents, even if the spending plan includes a reduction of 2 cents of its property tax rate, lowering 44.65 cents to 42.65 cents per $100 of assessed property valuation, the recommended budget will still raise over 4% more in property taxes than last year due to the recent spike in property prices. The document estimates that from a total of $8,511,965 difference in tax revenue, $2,444,064 will be raised from new property added to the tax roll this year.

“Given that Plano is one of the hottest housing markets in the North Texas area and the requirements that the Central Appraisal Districts are under to appraise at market value,” said Israelson, “most property owners find themselves with increased appraised property values.” According to the Collin County Appraisal District’s reports, the value of the average home in Plano has raised up to $493,927, 24.5% from the previous year.

While taxes are on the rise, the city surveys confirmed that the community does not want to see a reduction in services, and property taxes represent 44% of the source of revenue.

Yet, officials reminded residents that Plano has the maximum 20% homestead exemption and a $40,000 senior and disability exemption, as well as an over-65 tax freeze. In addition to these, the State of Texas mandates that the appraisal amount citizens pay taxes on is capped at 10% per year, even if the market value of the property has increased.

Council members called for a public hearing to be held during the general meeting on September 12, and they expect to approve the tax rate that night.